Forecast Update - May 2024

Update of Brent and WTI forecasts.

Dear subscribers,

At the beginning of each month, we will be sending you an email like this with an updated forecast of energy prices. Commodia brings together top academic economists who specialize in the analysis of global energy markets. The team has more than 20 years of experience from leading universities across the United States, Canada, Europe, and the Asia Pacific. Our forecasts are based on state-of-the-art forecasting techniques to predict energy commodity prices.

Learn more about the Commodia team:👤 About us

And about our econometric model: 📑 Econometric model

You can also always check our latest forecast on the website: 📊 Forecast Chart

🛢️Oil Market April Summary

Oil prices in April 2024, reaching their highest level since October 2023. This increase was driven by several factors, including:

Heightened geopolitical tensions in the Middle East, particularly between Israel and Iran.

Concerns about tighter global oil supplies due to production cuts by OPEC+ and refinery outages in Russia.

Brent crude oil, a major benchmark, reached $90 per barrel in early April. The price remained volatile throughout the month, but ended April slightly lower than its peak.

🟧 Forecast Update of Brent

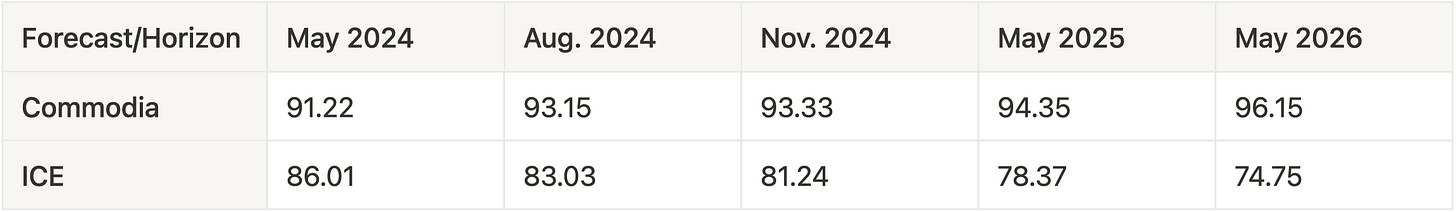

Commodia predicts that the spot price of Brent crude oil will be an average of $91.22 for May 2024. We forecast an average value of $93.15 for August 2024 and $93.33 for November 2024. We expect an average price of $94.35 for May 2025 and $96.15 for May 2026.

📈 Comparison to ICE forecast

Our forecast is around 6% lower compared to the ICE Brent1 crude oil futures contract in May 2024. Our long-term forecast is about 20% higher one year ahead (May 2025) and 29% higher two years ahead (May 2026) compared to the ICE Brent crude oil futures contracts.

🟥 Forecast Update of WTI

Commodia predicts that the spot price of WTI crude oil will be an average of $86.97 for May 2024. We forecast an average value of $86.79 for August 2024 and $87.27 for November 2024. We expect an average price of $88.66 for May 2025 and $89.71 for May 2026.

📈 Comparison to NYMEX forecast

Our forecast is around 10% higher compared to the NYMEX WTI2 crude oil futures contract in May 2024. Our long-term forecast is about 21% higher one year ahead (May 2025) and 29% higher two years ahead (May 2026) compared to the NYMEX WTI crude oil futures contracts.

🗝 Key drivers of Commodia’s crude oil forecast from the previous month

The key variables of Commodia’s crude oil forecast (Brent and WTI) are Global Fuel Consumption, Global Economic Conditions and OECD Petroleum Inventories. The main changes to our oil price forecast from April 2024 to May 2024 is that Global Economic Conditions have put upward pressure on oil prices.

This has implied that the long-term forecasts for oil prices have been revised upwards (5 percent for Brent, and 0.01 percent for WTI two years ahead).

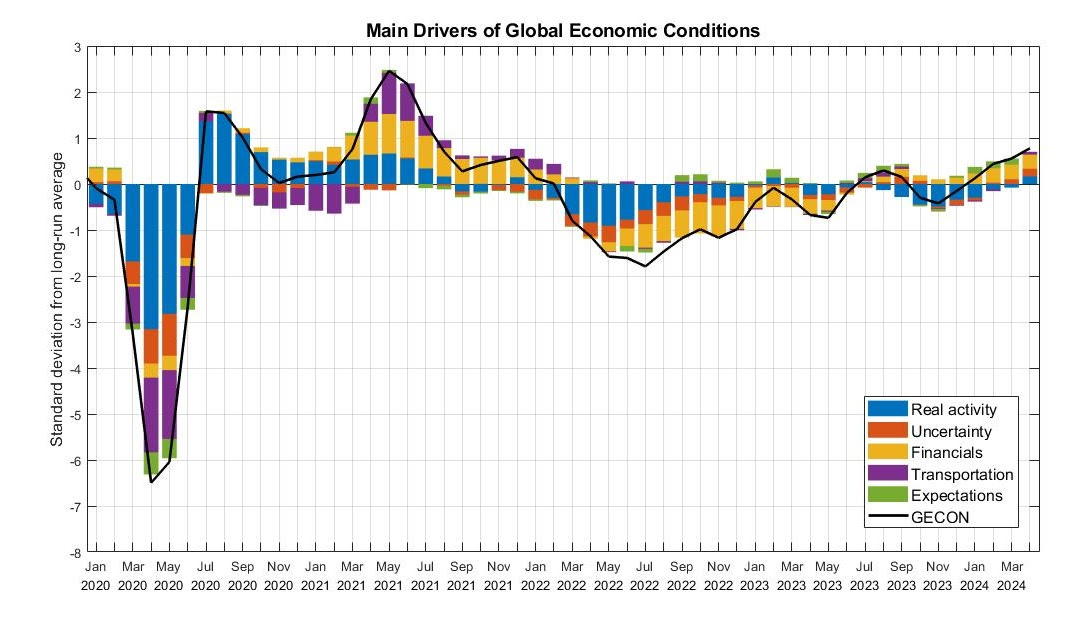

The main determinants of Global Economic Conditions are shown in the figure below:

Chart of Main Drivers of Global Economic Conditions from Christiane Baumeister & Dimitris Korobilis & Thomas K. Lee, 2022. "Energy Markets and Global Economic Conditions" The Review of Economics and Statistics, 104(4), 828-844.

The main determinants of Global Economic Conditions are shown in the figure above for the period January 2020 to April 2024.

For more details about the Global Economic Conditions index visit: https://sites.google.com/site/cjsbaumeister/research

Tell us what you think — Leave your comments and thoughts on our analysis and tell us what you think will happen in the market in the coming months.

⬇️ Download it — Download the forecast you saw in this report!

📊 Use it — See our forecasts and compare it with most popular market index.

🌐 Share it — Share this newsletter with your team or with someone to whom it might be useful!

All opinions and estimates in Commodia Website and Newsletters are given in good faith regardless of source, and the user assumes the entire risk related to using this information. Commodia and the authors are providing this information” as is,” and the authors and Commodia disclaim all warranties, whether expressed or implied, including (without limitation) any implied warranties of merchantability or fitness for a particular purpose. The authors and Commodia will not be liable for any damages or lost profit resulting from any use or misuse of this information.

Commodia Team

www.commodia.com

ICE: The data for ICE Brent crude oil futures contract is from https://www.theice.com. The data is downloaded and updated at the beginning of each month. Linear interpolation is performed when ICE monthly observations are not available.

NYMEX: The data for NYMEX crude oil futures contract is from https://www.cmegroup.com. The data is downloaded and updated at the beginning of each month. Linear interpolation is performed when NYMEX monthly observations are not available.